As families and advisors evaluate their corporate trustee options, we are often asked, “what goes into a trustee fee?”

From a historical perspective, bank trustees applied a “bundled” market-value based fee to cover trust services – covering both fiduciary administration and investment management. In 2014, new IRS regulations began requiring banks to “unbundle” their trust fees and allocate costs between these categories – for a variety of reasons, some banks struggled with this. As estate planning has evolved, however, new planning techniques, particularly the directed trust, have encouraged more fee transparency in the market. With such techniques, wealth management now contemplates the division of the trustee administration, investment and distribution functions to provide maximum flexibility for wealthy families and specific expertise that may not be found under one roof. This in turn allows a client to better know how their fees are allocated.

As an independent corporate trustee, Pendleton Square’s fee for trust services has always been clearly distinguishable from the third-party investment fees. But what goes into our trust fee?

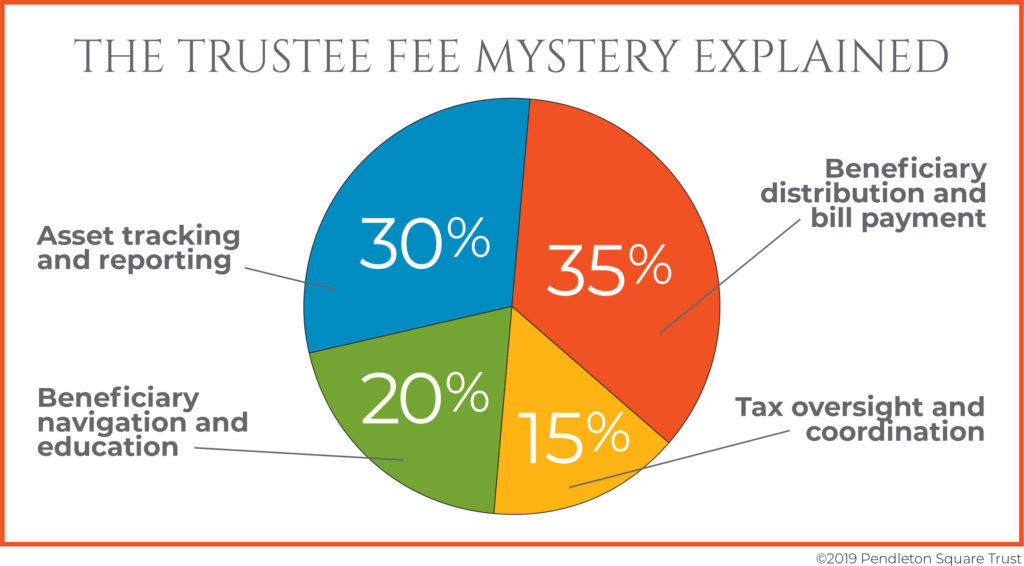

Our policy is to sign a fee agreement with each client, so that there is clarity and transparency about what is being charged. This agreement incorporates our standard fee schedule, but also lists fees for extraordinary services, such as real estate management, life insurance management and administering oil and gas interests. In cases where the standard fee schedule should not apply, we may be able to offer a different structure that is more appropriate to the client’s situation, such as a flat annual fee as opposed to a market-based fee. To help explain what’s involved in a standard trust fee, we can generalize a few components of trust administration and approximate how costs might be allocated. Here’s a breakdown:

Beneficiary distribution and bill payment

Providing for beneficiaries is an essential element of our job. Some of these duties are clear-cut. Many distributions are laid out plainly in the document, such as paying out the net income for a marital trust on a monthly or quarterly basis. In addition, we are frequently required to pay a number of third-party expenses, ranging from a beneficiary’s personal bills to paying the utilities on trust-owned real estate.

However, there are some distribution decisions that aren’t clear cut and require fiduciary judgment. For example, a beneficiary may request a discretionary distribution for their support and maintenance – a distribution that can only be made at the discretion of the trustee. Trustees take action on such requests in accordance with guidelines provided in the trust, the beneficiaries’ personal circumstances, tax implications, etc. The trustee must make their decision considering not only the specific requesting beneficiary, but also the interests of the other beneficiaries of the trust and the sustainability of the trust itself. Those interests may not always be aligned. This decision to distribute assets can have long term consequences and needs to be documented. Therefore, this process often involves information gathering and communication with beneficiaries and other advisors. Why is this important? As trustee, we need to ensure that the grantor’s intent as set forth in the trust document is fulfilled and that the needs (and wants) of beneficiaries are met when possible.

Providing for beneficiaries is an essential element of our job. Throughout the year, we consider their discretionary distribution requests under guidelines provided in the trust, their personal circumstances, tax implications, etc. We also make required distributions – such as paying out the net income for a marital trust on a monthly or quarterly basis. In addition to beneficiary payments, we also pay a number of third-party expenses, ranging from a beneficiary’s personal bills to paying the utilities on trust-owned real estate.

Asset tracking and reporting

Asset tracking and reporting is also a critical element of what we do. Not only are there both state and federal requirements for record keeping, but clients want to know what’s going on with their trust accounts. With every transaction, we must ensure that coding is correct for tax purposes and the description is clear for client reporting. And for most trusts, we must allocate funds into separate principal and income buckets, to ensure fairness to both current and remainder beneficiaries and proper tax reporting.

With the popularity of illiquid and special assets like closely-held businesses, real estate, art and even crypto-currencies, we often have to interface with practitioners and valuation experts to ensure that that trust has clear ownership of the assets and that our reporting is accurate. By providing our clients with paper statements and an online portal, the communication around the disposition of these assets can remain clear and seamless.

Asset tracking and reporting is also a critical element of what we do. Not only are there both state and federal requirements for record keeping, but clients want to know what’s going on with their trust accounts. With every transaction, we must ensure that coding is correct for tax purposes and the description is clear for client reporting. And for most trusts, we must allocate funds into separate principal and income buckets, to ensure fairness to both current and remainder beneficiaries. We provide our clients with paper statements, as well as offer access to an online portal.

Beneficiary navigation and education

One of the biggest threats to wealth is the lack of communication amongst beneficiaries. Misunderstanding leads to conflict and conflict can lead to expensive litigation. Beneficiary education can mitigate this risk. Working with beneficiaries is a big reason why our trust officers chose this profession. Their goal is to help beneficiaries understand the parameters of the trust document, why it was created and ensure the grantor’s legacy. In some cases, this may include attending family meetings, presenting to the advisor team about the practical workings of the trust, or providing educational seminars to younger generations.

Tax oversight and coordination

Taxes impact many of the decisions we make as fiduciaries, more so with more complex trust structures. This can include taxes from multiple states, as well as both fiduciary and corporate federal taxes. One wrong decision can expose the trust to adverse tax consequences. And for most every trust, there is the annual ritual of gathering K-1s and 1099s, having a tax return prepared, and then filing and making any payments by the deadline.

To accomplish the above effectively, a corporate trustee must have both a complex system of operations and highly qualified administrators. We spend a lot on technology to reduce risk, make timely distributions, ensure accurate reporting and provide efficient fiduciary decision-making for our clients. We also must spend on people – experts, not only in fiduciary administration, but with deep backgrounds in related areas, such as banking and family-held businesses. With Pendleton Square, you don’t receive a robo-advisor or 800 number, you receive an experienced trust officer backed by a sophisticated technology operation.

This provides some insight into the functions of a trustee and where the time is spent performing trustee functions. To learn more about our services as an independent corporate trustee, contact us to speak with one of our trust officers.