Selecting the appropriate trustee for your family may be as important as creating the trust itself. As the trustmaker, you want to be assured that the trust will be administered with the care and attention with which it was created. You have several options to explore to determine the best trustee structure for your family.

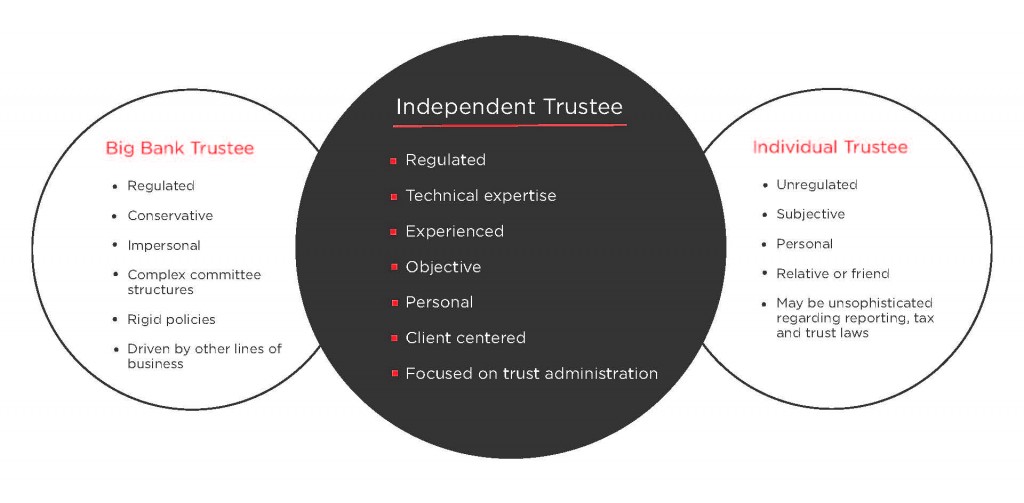

Your options for a trustee may be explained as points along a continuum. On one end is the traditional corporate trustee, typically a large traditional bank trustee designated to manage and invest the trust assets. On the other end is the individual trustee, typically a trusted family member who is not compensated for his or her duties, and may or may not have any investment expertise. In the middle of the continuum is an independent trustee, such as Pendleton Square, that focuses on trust administration and works with a qualified 3rd party investment advisor who makes investment decisions. This option is a unique blend of the individual and traditional trust company characteristics as illustrated below:

The independent trustee captures the key benefits of both ends of the continuum, while eliminating several disadvantages. The independent trustee represents the best of both worlds.

The independent trustee model is designed to be free from the conflicts of interest often encountered in the traditional channels. The independent trustee is not affiliated with a larger controlling financial unit that may guide decision making. Unlike the traditional corporate trustee, the independent trustee does not provide investment services, so as to avoid any conflict between offering investment products and serving the client. In contrast to the individual trustee, who is typically a family member, the independent trustee focuses on making objective decisions without emotion, either as sole trustee or with a family member co-trustee. Unlike an individual who may become disabled or suddenly pass away, an independent trustee is perpetual in existence and may serve a family through the generations.

Most independent trustees, including Pendleton Square, are regulated entities with the same legal, accounting and administrative expertise as traditional bank corporate trustees. However, the independent trustee represents the appropriate balance between the rigid policies of the traditional trust department and the subjective, unregulated nature of an individual trustee.

Similar to the individual trustee, the independent trustee is an important family partner that seeks to ensure that the grantor’s intentions are fulfilled. Independent trustees are focused on trust administration and family relationships, while providing advice that is objective and within the guidelines of the trust document. Objectivity is at the center of everything an independent trustee provides. The focus on doing one function and doing it well, leads to the highest standards of care and client experience. Though the independent trustee does not offer investment management services, it works seamlessly with your family’s trusted advisors (financial advisors, estate planning attorneys, tax advisors, insurance partners and other family consultants) to bring the family a best-in- class delivery model. In addition, an independent trustee may be more open to maintaining “non-conforming” assets within a trust structure, such as real estate, business interests, and other non-financial assets.

If you are a trustmaker especially interested in the generational health of your family, the independent trustee is the best partner to maintain health and harmony for generations to come.